Rattle off a list of the greatest oil magnates of the 19th and 20th centuries for me.

Go ahead and take your time. I’ll wait.

I’m sure most lists include notable names like Rockefeller, Getty, and H.L. Hunt. Perhaps a few of you would’ve added legends like Edwin Drake, who drilled the very first commercial oil well in the United States in Titusville, Pennsylvania, back in 1859.

Nearly everyone would’ve overlooked a man named Edward Doheny.

Haven’t heard of him? Don’t feel too bad; there are few investors today who would recognize that name.

After moving his family to Los Angeles in 1892, Ed quickly noticed the thick tar that oozed its way to the surface. Then, without a penny to his name, Doheny convinced his buddy to spot him $400 so he could buy a small, three-acre plot of land near those seeps.

Using just picks and shovels, Edward went only 200 feet before he struck oil, and even though a few wells were dug in Los Angeles before him, he’s credited with drilling the first successful well in the field.

And it was his discovery that ignited an oil boom in the area.

Oil Explosion Rocks U.S. Investors

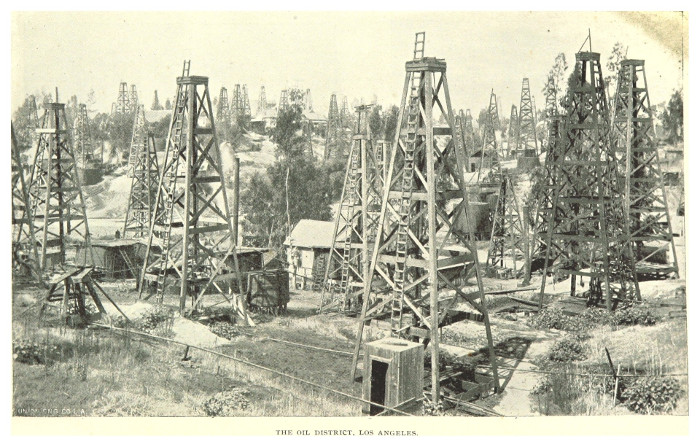

Soon after Edward Doheny struck oil, the Los Angeles oil field was littered with thousands of oil wells:

That wasn’t enough.

Just as the Los Angeles field peaked in 1901, Edward had already turned his sights south towards Tampico, Mexico, where his company, the Pan American Petroleum and Transport Company, drilled its first oil well that eventually helped open up new Mexican oil fields.

In fact, it was one of Doheny’s companies, the Mexican Petroleum Company (which later became Pemex), which drilled a gusher in Cerro Azul.

The sound of this monster oil well was rumored to be heard more than 16 miles away, and the well went on to pump over 57 million barrels over the next 14 years.

Forget Rockefeller, dear reader; Pan American reigned as the largest American oil company for a spell before it was taken down by the Teapot Dome scandal.

Through it all, there was one formula that never failed the great oil tycoons of the past like Edward Doheny.

It’s been repeated over and again for more than a hundred years in the oil industry.

You know a few of them today, actually.

The more recent drillers that come to mind are men like Harold Hammer, who took the time to learn the geology, crack the code, and tap into previously abandoned oil plays like the mighty Bakken and Three Forks formation in North Dakota.

And once again, history is repeating itself… with the next profit cycle in crude already underway.

The question you should be asking yourself now is whether you plan to sit on the sidelines again.

Rise early, work hard, and strike oil.

These famous words from oilman J. Paul Getty are a recipe for success and a motto for every up-and-coming E&P company in the United States today.

Of course, it’s that last part that holds a particular interest for individual investors like us. As I told you last week, we want to find those investment gems in the U.S. oil patch before the herd piles in.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

How does that saying go again? If you’re not first, you’re last.

In the case of one tiny $10 million driller in Texas, it’s certainly the former.

But I’m not talking about plays like the Permian Basin, where every eye in the sector has been focused and acreage can run for $50,000 to $60,000 a pop.

No, these guys just happened to be the only ones paying attention when an historical drilling breakthrough took place in the Red Cave formation in the Texas Panhandle.

Rather than rushing to put their drill bit into the dirt, however, they took the time to learn the geology and the formula to tap into this virgin oil play.

Then, still under Wall Street’s radar, these guys started quietly amassing a major position in the sweetest spots of this play.

Last month, we learned that this company started selling its oil on the open market.

The moment that happened, I knew right away my readers and I had an ace up our sleeve.

And now that its drilling activities are kicking into high gear, it’s only a matter of time before the herd catches wind of it.

When that happens, it’ll be far too late to take advantage of this opportunity.

Fortunately for you, we haven’t reached that point… yet.

We just made our move, and this is how we’re doing it.

But I can only open the door… it’s up to you to take the next step.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.